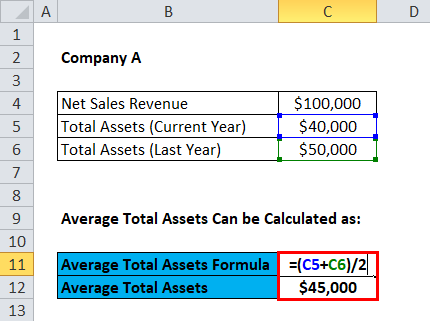

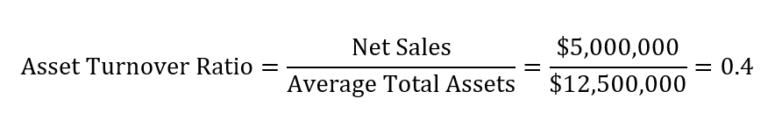

This is essential in the prudent reporting of the net revenue for the entity in the period.įixed-asset turnover is the ratio of sales (on the profit and loss account) to the value of fixed assets (on the balance sheet). It is, therefore, obligatory that in order to accurately determine the net income or profit for a period depreciation, it is charged on the total value of asset that contributed to the revenue for the period in consideration and charge against the same revenue of the same period. The use of assets in the generation of revenue is usually more than a year–that is long term. Matching concept is simply matching the expenses of a period against the revenues of the same period. In the attainment of this objective, it is required that the management will exercise due care and diligence in applying the basic accounting concept of "Matching Concept". The primary objective of a business entity is to make a profit and increase the wealth of its owners. According to International Accounting Standard (IAS) 16, Fixed Assets are assets which have future economic benefit that is probable to flow into the entity and which have a cost that can be measured reliably. These often receive favorable tax treatment (depreciation allowance) over short-term assets. Asset turnover (ATO), total asset turnover, or asset turns is a financial ratio that measures the efficiency of a companys use of its assets in generating. These are items of value that the organization has bought and will use for an extended period of time fixed assets normally include items, such as land and buildings, motor vehicles, furniture, office equipment, computers, fixtures and fittings, and plant and machinery. Each aforementioned non-current asset is not sold directly to consumers. Its non-current assets would be the oven used to bake bread, motor vehicles used to transport deliveries, cash registers used to handle cash payments, etc. As an example, a baking firm's current assets would be its inventory (in this case, flour, yeast, etc.), the value of sales owed to the firm via credit (i.e., debtors or accounts receivable), cash held in the bank, etc.

A higher ratio is generally favorable, as it indicates. Comparing the ratios of companies in different industries is not appropriate, as industries vary in capital.

Moreover, a fixed/non-current asset also can be defined as an asset not directly sold to a firm's consumers/end-users. Key Highlights The asset turnover ratio measures is an efficiency ratio that measures how profitably a company uses its assets to. In most cases, only tangible assets are referred to as fixed. This can be compared with current assets, such as cash or bank accounts, which are described as liquid assets. Fixed assets, also known as a non-current asset or as property, plant, and equipment (PP&E), is a term used in accounting for assets and property that cannot easily be converted into cash.

0 kommentar(er)

0 kommentar(er)